fresh start initiative irs reviews

Within the IRS Fresh Start Initiative program there are different tools available to help struggling individuals and small businesses pay off andor get rid of some of their debt. The IRS Fresh Start Program launched in 2011 is an initiative designed to make it easier for taxpayers to resolve tax debt by giving them a fresh start with the Internal Revenue Service.

![]()

What S The Irs Fresh Start Program The New Initiative Guide Video

This expansion will enable.

. 1 36-month repayment for balances of 10000 or less 2 72-month. This blog post will introduce what the IRS Fresh Start Initiative is about and how it works. The IRS Fresh Start program can help deserving taxpayers get back on their feet financially.

The following four tips explain the expanded relief for taxpayers. With an A BBB rating and over 100 customer reviews with an average rating of five stars Community Tax is a Solvable top-rated tax assistance firm. There are various tax relief programs offered under the IRS Fresh Start Initiative commonly referred to as the IRS Fresh Start Program.

Best for individuals with over 8000 in debt. There are three types of streamlined Installment Agreements. Most Offers in Compromises are rejected because they are reviewed for proper format yet are not processed due to being formatted wrong.

Fresh Start Initiative is a relative newcomer in the tax relief industry. IRS Fresh Start Program Taxpayers that have back taxes may qualify for tax relief in as little as 20 minutes. In 2011 the Internal Revenue Service announced a series of new steps to help people get a fresh start with their tax liabilities.

The IRS will continue to review and where appropriate modify or expand the People First Initiative as we continue reviewing our programs and receive feedback from others Rettig said. Penalty relief Part of the initiative relieves some unemployed taxpayers from failure-to-pay penalties. This program allows people to make a one-time payment of their IRS tax debt and avoid penalties and interest.

The Program offers taxpayers relief with their back taxes. Specifically the IRS is announced new policies. The IRS Fresh Start Program helps taxpayers who owe the IRS by aiding taxpayers with paying back taxes and avoiding tax liensIt is an irsgov payment planChanges implemented by the program largely revolved around tax liens installment agreements offers.

Relief under the IRS Fresh Start Initiative. Fresh Start Initiative is a tax relief matching service for those struggling with tax debt. Money-Back Guarantee if overall tax liability or monthly payments arent reduced.

In the vast majority of cases taxpayers will still pay a large portion of the taxes due. If so the IRS Fresh Start program for individual taxpayers and small businesses can help. Fresh Start Initiatives can be reached at 855 922-3557.

However in some cases the IRS may still file a lien notice on amounts less than 10000. Ultimately the goal is to allow citizens to pay taxes without liens and excess fees. Within the Fresh Start Initiative there are different types of relief available.

The IRS began Fresh Start in 2011 to help struggling taxpayers. This is actually the most helpful IRS Fresh Start program of course ignore their nonsense offer in compromise pre-qualifier as it is garbage. The IRS Fresh Start Program offers tax debt relief and is an umbrella term for the various options offered by the IRS.

So helpful I actually wonder how much longer it will last. Not having the funds available to cover a tax bill can feel devastating. However taxpayers should be aware that this isnt a magic wand or get out of jail free card.

The two most popular are Offer in Compromise and payment plans. The two most common repayment options under the Fresh Start Program are extended installment agreements and Offer in Compromise OIC. January 6 2022.

We are committed to helping people get through this period and our employees will remain focused on these and other helpful efforts in the days and weeks ahead. If you cant fully pay your tax bill then you may qualify for one or more options under the IRS Fresh Start Program. If you owe 10K or more call now for a free case review.

Tax Fresh Start Initiative Offerings. Service-fee financing options available. New IRS Fresh Start Initiative Helps Taxpayers Who Owe Taxes.

IRS Fresh Start Initiative in Texas. The company is based out of Ladera Ranch California. The goal was to help individuals and small businesses meet their tax obligations without adding unnecessary burden to taxpayers.

Each has its own set of. Since the IRS is such a powerful entity it can be intimidating to work with them directly. For some individuals this scenario can haunt them for some time.

The IRS Fresh Start Streamlined Installment Agreement allows you to quickly set up an Installment Agreement with the IRS to repay back taxes over a fixed period with a fixed monthly payment usually without providing financial information. The IRS changed reasonable collection potential calculations from multiplying your. The Fresh Start Initiative grants more flexible repayment terms for taxpayers to pay or absolve their back taxes without incurring penalties.

The company partners with companies that employ IRS enrolled agents Certified Public Accountants and tax attorneys to help consumers address and resolve tax debts. The Fresh Start program increased the amount that taxpayers can owe before the IRS generally will file a Notice of Federal Tax Lien. The Internal Revenue Service has expanded its Fresh Start initiative to help struggling taxpayers who owe taxes.

IRS Fresh Start Offer in Compromise. Once referred to as the Fresh Start Program the Fresh Start Initiative is actually an updated set of guidelines for pre-existing IRS programs that help more people qualify for some much-needed tax debt relief. This is called an Offer in Compromise or what is commonly called the IRS FRESH START PROGRAM.

Now to help a greater number of taxpayers the IRS has expanded the program by adopting more flexible Offer-in-Compromise terms. They offer a streamlined approach to tax relief and utilize many partners such as certified public accountants enrolled agents and other tax experts to match the consumer with the professional who can help their case the most. Basically this is how this IRS Fresh Start program works.

2022 Fresh Start Initiative Reviews. If you are a US taxpayer or have IRS tax debt you may be eligible for the IRS Fresh Start Initiative. Offers that make it past this point at the IRS must choose the proper type of Offer.

According to irsgov An offer in compromise OIC is an agreement between a taxpayer and the Internal Revenue Service that settles a taxpayers tax liabilities for less than the full amount owed The Fresh Start Program expanded the OIC program creating more. IRS tax problems can be overwhelming. The Fresh Start initiative offers taxpayers the following ways to pay their tax debt.

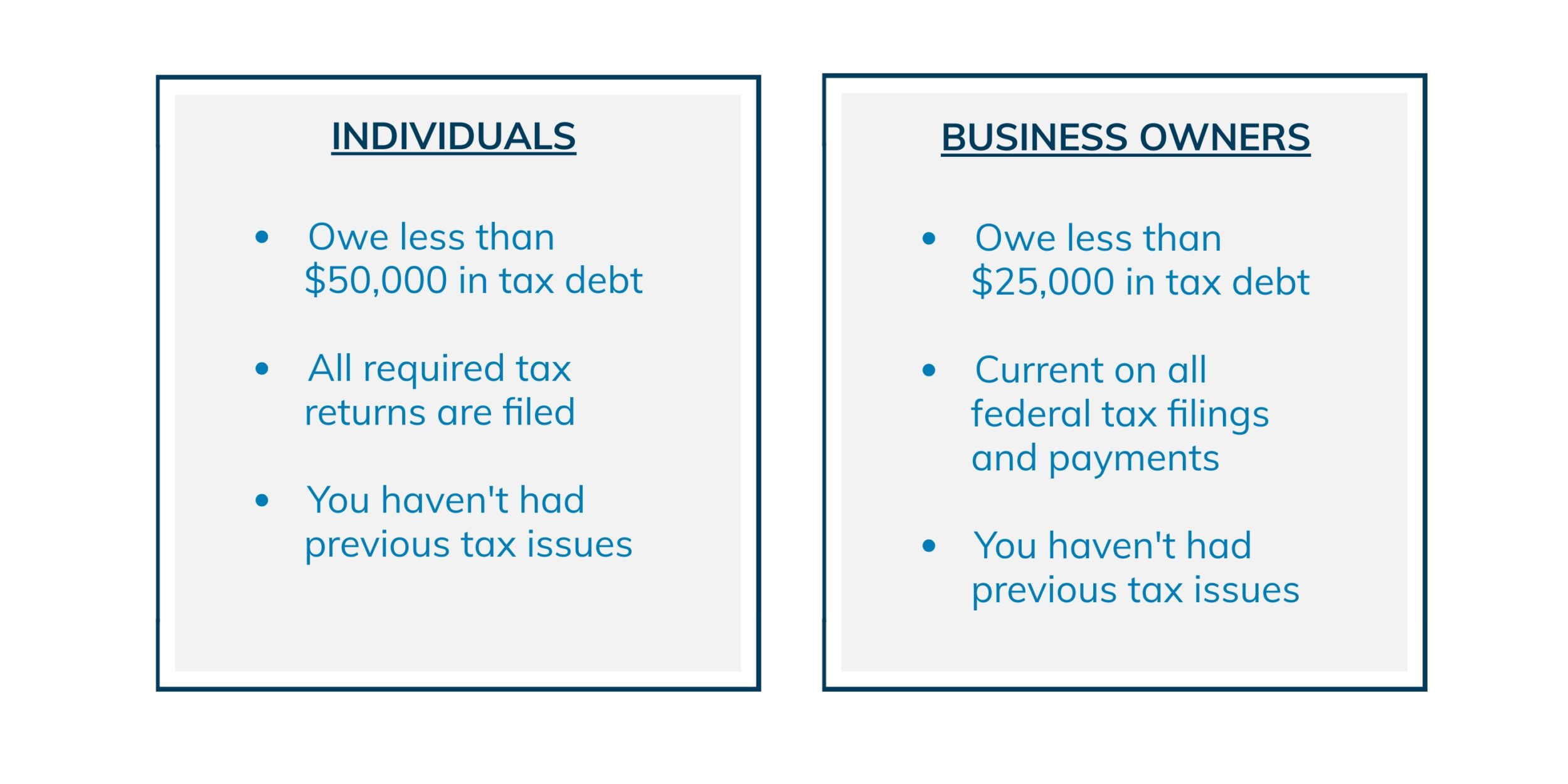

IRS Fresh Start Program Qualifications. Finding an option to settle your tax debt is a lot easier now as the tax relief options available add more potential ways to mitigate tax debts if. That amount is now 10000.

The reason is that the Fresh Start Initiative changed IRS collection policy to lower the total. For example a taxpayer who qualifies for an OIC see this article about OIC qualification and has 500 in monthly disposable income and 5000 in net equity in assets would see their OIC offer amount drop from 29000 pre-Fresh Start to 11000 with Fresh Start. Finally under the Fresh Start Initiative the IRS made the Offer in Compromise program more accessible.

Quickly Solve Your IRS Problems - Free Consultation. Community Tax has expertise in releasing tax liens and can help you get IRS resolution through the IRS Fresh Start program.

Does The Irs Offer One Time Forgiveness Tax Debt Advisors

Everything You Need To Know About The Irs Fresh Start Initiative 2019

What S The Irs Fresh Start Program The New Initiative Guide Video

3 Ways To Be Eligible For The Irs Fresh Start Program

3 Ways To Be Eligible For The Irs Fresh Start Program

Irs Fresh Start Connecting Taxpayers With Tax Professionals

Fresh Start Initiative Review February 2022 Shop Tax Relief

Owe Money Get A Fresh Start With The Irs Fresh Start Initiative The Turbotax Blog

What Is The Irs Fresh Start Program Fresh Start Initiative Explained Clean Slate Tax

Am I Eligible For The Irs Fresh Start Program Tax Defense Network

Follow Irs Fresh Start Initiative On Other Platforms Fresh Start Social Media Irs

Irs Tax Debt Relief Forgiveness On Taxes

3 Ways To Be Eligible For The Irs Fresh Start Program

Everything You Need To Know About The Irs Fresh Start Initiative 2019

![]()

What S The Irs Fresh Start Program The New Initiative Guide Video

Irs Fresh Start Program How It Can Help W Your Tax Problems

Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program